UAE SME lending startup CredibleX raises AED200 million in seed round

CredibleX, a working capital finance platform for UAE SMEs, have announced that it has raised AED200 million in its seed round, led by Further Ventures.

Wafeq raises USD$7.5 Million in Series A funding to accelerate accounting digitization for MENA SMEs

Wafeq, a modern and easy-to-use accounting platform, have announced the completion of its USD$7.5 million Series A funding round.

UAE fintech Ziina raises $22 million in Series A funding round led by Altos Ventures

UAE fintech Ziina have announced that it has raised $22 million in a Series A funding round led by US-based Altos Ventures.

UAE fintech startup Mamo closes $3.4 million funding round

Mamo, a UAE-based fintech startup, have announced the successful completion of a $3.4 million funding round.

Hub71 fintech startup Dopay secures $13.5 million Series A extension round led by Argentem Creek Partners

Dopay, a rapidly growing fintech startup, have closed a strategic $13.5 million Series A extension round led by Argentem Creek Partners.

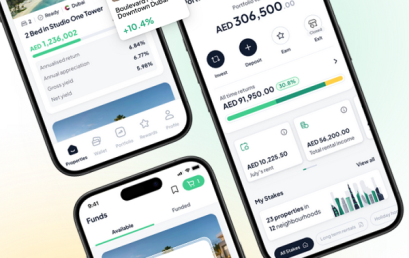

Real estate fintech platform Stake secures $14 million in Series A funding led by Middle East Venture Partners

UAE fintech Stake have announced that they have raised $14 million in funding led by Middle East Venture Partners.

UAE direct mortgage platform Holo in pre-Series A funding round

Holo, the largest direct mortgage platform in the Middle East, have announced the completion of an oversubscribed funding round.

Fintech funding continues to surge as Second Edition of Dubai FinTech Summit commences

The MENA FinTech market is expected to register a CAGR of over 8% during the period 2024 to 2029, as fintech funding surges.