UAE fintech Pasiv granted regulatory authorization by DFSA, unveils chat-based investment app

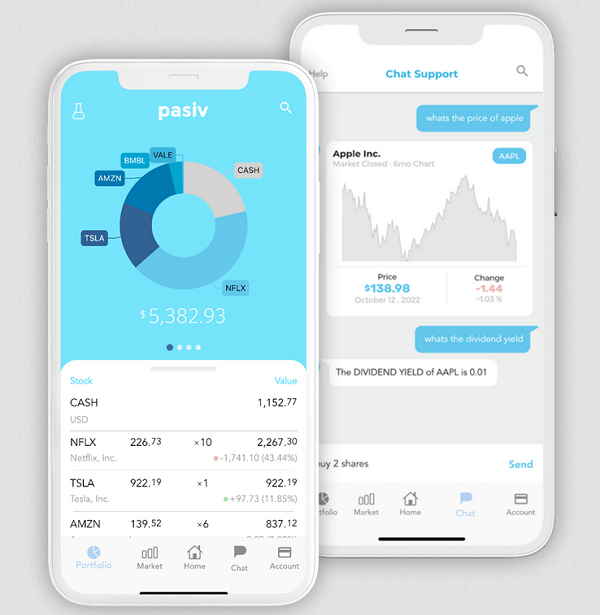

Dubai-based UAE fintech Pasiv has unveiled its proprietary chat-based investment app for wealth management. The app has been developed as a conversational AI, intended to help people to manage their long-term investments in US stocks and ETFs. The company provides US securities through ChoiceTrade, a US-based regulated broker-dealer. The company aims to make retirement saving and investing accessible, in a market flooded with apps geared towards trading as opposed to long-term passive investing.

Pasiv seeks to fill the absence of a financial communication medium that can provide financial literacy, market data and investment tools to average investors, which typically only financial advisors have access to. Their chat-based investment app attempts to fill that gap as an innovative purpose-built solution, combining both virtual and human support when investors need it. The company’s technology can also be repurposed for regulated financial institutions to facilitate communication among investors, wealth managers and advisors.

Wall Street banks were recently fined $2 billion collectively for unauthorized messaging taking place on WhatsApp and other chat platforms. Pasiv’s solution is an attempt to build a purpose-built medium for a financial chat, where a transcript can be saved and produced to regulators and compliance officers.

“Our aim is to enrich the experience of wealth management, with cutting-edge tools and artificial intelligence. Part of this mission means making investing accessible and affordable to the average investor. Our incredibly talented and dedicated crew of fintech enthusiasts make this possible behind the scenes,” said Vinay Gokaldas, Founder and CEO of Pasiv Financial.

The conversational AI developed by Pasiv enables the user to talk to a virtual assistant and conduct research on stocks & funds through simple chat commands, such as “what are the analyst ratings on this stock” and “what is the price of Apple?”. The chat interface allows investors to also execute trades directly with the assistant. Users have access to carbon intensity scores, fund holdings and fund performance, balance sheets, financial ratios, etc., allowing them to access data quickly and make informative investment decisions. It also facilitates responsible investment by enabling the users to filter for funds based on their ESG score. Pasiv goes beyond traditional brokerage apps by providing its users with a portfolio lab, where they can backtest a portfolio and see how it performed in the past vs the benchmark index.

“We believe there’s a market of affluent passive investors who are looking for more than just commission-free investing today – millennials and Gen Zs who have sat through multiple financial crises in their lives are looking for portfolio tools that can give them the edge to better manage risk. We’ve spent the past year in DFSA’s innovation sandbox testing this technology, and we’re thrilled to have been granted regulatory approval to open it up to ordinary retail investors,” Vinay Gokaldas added.