Trigger Software and Sigma Software partner on digital banking projects

UAE’s Trigger Software has agreed to work together with Sigma Software on the projects in the digital banking space.

Trigger Software develops its own proprietary technologies: Trigger Neobank Engine (TNBE) and Trigger API Gateway (TAG).

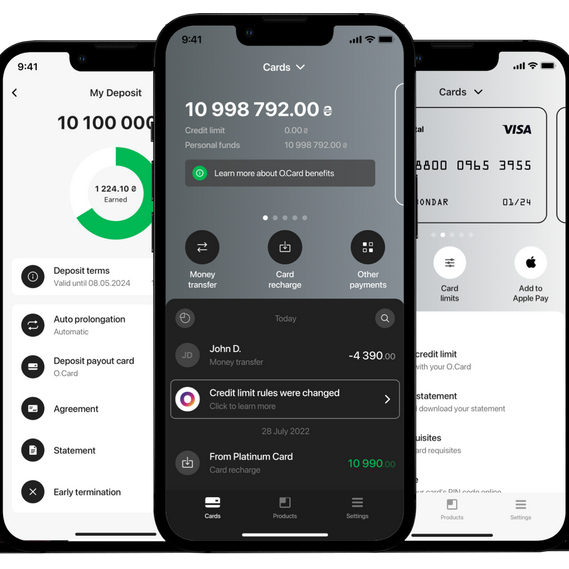

TNBE includes 300+ pixel-perfect visual layouts and 150+ ready-made business processes, like KYC, onboarding, payments, remittances, loans, deposits, cards, cashback, referral bonuses, crypto integrations, and others.

Also Trigger provides Trigger Interface Constructor (TIC), which allows to easily configure the interface both for iOS and Android apps. TIC renders the JSON into beautiful screens that can be instantly changed without the need to update the app on App Store or Google Play market.

Trigger API Gateway allows to build and deploy production-ready API with authorization in less than 1 minute. TAG supports building APIs on top of PostgreSQL, MsSQL, MySQL, Oracle, MongoDB and AWS S3 for working with files. TAG also supports AI integration to let users create API requests using the natural human language, instead of SQL syntax.

Commenting on the partnership, Hanna Khrystianovych, Head of Partnerships at Sigma Software, said, “Having a broad Fintech expertise and network, we can spot innovative products that can facilitate digitalization for our customers in the Finance and Banking industry. Sigma Software unites such products in our partner ecosystem to provide time- and cost-efficient solutions to cover the needs of current and potential clients. With Trigger Neobank Engine, we can furnish full-scale digitalization for our clients in the Finance and Banking industry. Trigger enables providing banking services via digital means at incredible speed.”

Max Bondar, Founder and CEO of Trigger Software, added, “Trigger Neobank Engine helps banks, fintechs, credit unions, retailers, telcos to launch their own digital neobank. Customers can have a digital neobank up and running in 6 months at a fixed cost, with an opportunity to easily develop and add new features in future.”